Nga *Elvis Ponari

Jetesa sa vjen dhe bëhet më e shtrenjtë, çmimet dhe inflacioni rriten ndërsa vlera e lekut ulet.

Dhe ndër grupet shoqërore që e vuajnë më së shumti këtë gjë janë personat që do të dalin në pension, të cilët vit pas viti janë më të varfër.

Problemet e papunësisë, të informalitetit dhe veçanërisht të emigracionit në moshë pune kanë ulur ndjeshëm përqindjen e popullsisë kontribuuese në 15 vitet e fundit, duke krijuar shqetësim të madh social për të ardhmen.

Projeksionet tregojnë se deri në vitin 2030, popullsia në moshë pune do të tkurret në mënyrë sistematike dhe nga ana tjetër, numri i pensionistëve do të rritet me shpejtësi, duke vënë në rrezik skemën e pensioneve

Marrja e masave konkrete është domosdosshmëri nëse nuk duam që kjo të shkojë drejt

humnerës.

Një shembull për ta bërë më të qartë situatën: nëse ne në 2020-ën ne kishim 1.4 kontribuues për 1 përfitues, treguesi ra në 1.17 kontribuues për një përfitues në marsin e vitit 2022.

Çfarë duhet bërë?

Evropa ka vite dhe dekada që e ka menduar këtë gjë duke bërë të mundur ruajtjen e standardit të jetesës për qytetarët e saj, edhe kur ata ndalojnë së punuari. Sepse cilësia dhe fuqia e një shteti janë qytetarët e vet.

Kur qytetarët e një shteti punojnë dhe në moshën e pensionit kanë të ardhura të mjaftueshme, ai është më i fuqishëm, ecën përpara dhe ekonomia zhvillohet.

Në Shqipëri funksionon krejt ndryshe: Shumë pak njerëz punojnë, shumë pak njerëz kanë rroga të mira, dhe shumë/të gjithë pensionistë të varfër. Kjo bën që, ata që ende punojnë mbajnë ende me lekë pensionistët. Ose i mban shteti. Është e kotë!

Pra, shteti duhet të mendojë që pensionistët, ashtu siç do qytetar tjetër, të jetë i pavarur.

Kur qytetari është i pavarur financiarisht, ekonomikisht, shteti është i fuqishëm.

Shteti ka hartuar ligje, ka ndërtuar “rrugën” që njerëzit të punojnë, të fitojnë, të shijojnë, të kursejnë dhe kur të dalin në pension të vazhdojnë sërish me të njëjtin standard jetese. Sepse qytetari e ka dhënë kontributin gjatë jetës. Ka punuar dhe në vlerësim të kontributeve të paguara duhet të shpërblehet.

Por le të ndalemi pak tek pensionet dhe si funksionon skema në Europë?

Shteti thotë: “Po, një pjesë të taksave që unë i marr nga sigurimet shoqërore do ti kaloj tek skema private, që ato të akumulohen, të investohen, dhe kur të dalësh në pension të marrësh më shumë para”. Kjo është e gjitha.

EVROPA NUK KA PENSIONE MË TË LARTA SE NE!

Evropa nuk ka pensione më të larta se ne. Evropa ka thjesht 3 mundësi pensioni (nga shteti, nga privati me shtetin dhe nga privati). Kjo mungon sot në Shqipëri!

FMN, Banka Botërore dhe ISSH janë bashkuar për t’i gjetur një zgjidhje këtij defiçiti, këtij

problem.

Të bëjnë atë që bërë Evropa në vitet ’90, duke aplikuar skemën private.

Paratë që kursehen, që investohen në fond privat, zhvillojnë ekonominë. Shembulli më i thjeshtë dhe më i afërt është ai i shtetit fqinj, Maqedonia e Veriut, e cila zhvilloi skemën private të pensioneve në 2015-ën, sipas sugjerimeve të Bankës Botërore. (Ne në Shqipëri nuk e bëmë këtë gjë)

Dhe sot, Maqedonia e Veriut ka mbi 2 miliardë Euro asete duke ndikuar edhe në zhvillimin

ekonomik të vendit (rrugë, shkolla, aeroporte etj). Këto para janë grumbulluar, janë investuar, kanë dhënë kthim dhe e gjithë kjo i shkon individit si pension.

Dhe sot pensionisti maqedonas e ka pensionin më të lartë sesa një pensionist shqiptar (Pensioni mesatar në Maqedoninë e Veriut 278 Euro; në Shqipëri 126 Euro).

Kalimi në kolonën e tretë të skemës private, zgjidhja më e mirë

Kjo skemë është në mirën e qytetarit, pasi edhe kthimet në interesa janë më të larta, edhe se bankat.

Sipas ligjit të ri për pensionet private, i future në fuqi në fund të vitit të shkuar, kufiri maksimal mujor i përjashtimit tatimor rritet deri në nivelin e pagës minimale të miratuar, që aktualisht regjistrohet në 40 mijë lekë në muaj.

Nga kjo incentivë, shuma e kontributeve e përjashtuar nga tatimet arrin deri në 480 mijë lekë në vit ose 140% më shumë krahasuar me pragun që ishte caktuar në ligjin e vjetër prej 200 mijë lekësh.

Konkretisht, neni 156 i ligjit përcakton se, kontributi i bërë nga çdo anëtar i një fondi pensioni zbritet nga të ardhurat personale të tij për efekt tatami. Kthimi i investimit, përfshirë fitimet nga kapitali prej investimeve të kryera me aktivet e fondit të pensionit nuk i nënshtrohen tatimit, as për vetë fondin e pensionit dhe as për shoqërinë administruese.

Kontributet e bëra nga punëdhënësi dhe çdo kontribuues tjetër, në emër dhe për llogari të anëtarit të një fondi pensioni, për efekte fiskale, nuk vlerësohen si të ardhura personale të anëtarit. Kufiri maksimal mujor, për lehtësitë tatimore, është deri në nivelin e pagës minimale të miratuar në

shkallë vendi.

Edhe kontributet e pensionet privat të derdhura nga punëdhënësi në favor të punëmarrësit do të përjashtohen nga tatimi në të njëjtën masë.

Specifikisht, sipas nenit 157 të ligjit “Kontributet e bëra nga punëdhënësi në interes të

punëmarrësve të tij në një fond pensioni vlerësohen shpenzim operativ deri në shumën vjetore për çdo punëmarrës, të barabartë me pagën minimale vjetore të miratuar në shkallë vendi, dhe kjo shumë vlerësohet shpenzim i njohur për qëllime të tatimit mbi fitimin”

Sipas shifrave më të fundit nga AMF, sot në skemën private të pensioneve janë 38 anëtarë, ose 1 % apo 2 % e fuqisë punëtore. Shifër që ka ardhur gjithnjë e në rritje por gjithësesi shumë e ulët pasi minimalisht duhej të ishin 25 % apo 30% e tyre.

Kjo është gjëndja sot. Ndaj, mes masave që duhen ndërmarrë për përmirësimin e tregut të

pensioneve është zhvillimi i skemave private. Ky sistem është një kërkesë e domosdoshme e kohës.

Skema private e pensioneve zgjidh problemet që dikton koha

Së pari, zgjidh kontradiktën e brezave, duke e bërë brezin e ri më të interesuar për t’u siguruar.

Së dyti, zgjidh ul informalitetin. Një fenomen mjaft shqetësuese për ekonominë shqiptare, i cili

zë rreth 30% të saj.

Së treti, ofron përfitime në kushte më të favorshme moshe, vjetërsie në punë e masë pensioni. Si

dhe kanë një transparencë e sistem fiskal mjaft favorizues.

Këto dhe shumë arsye të tjera bëjnë që sot pensionet private po zhvillohen me ritme të larta në të gjithë vendet e botës.

PSE “SIGAL UNIQA Fond Pensioni”? hyperlink ( www.fondisigal.com.al )

Ekspertiza: Me 18 vite përvojë në fushën financiare, “SIGAL UNIQA Fond Pensioni” ofron

njohuri të thellë në këtë fushë duke ofruar zgjidhje për të përmbushur nevojat unike të kompanisë suaj dhe jo vetëm.

Përshtatja: “SIGAL UNIQA Fond Pensioni” bashkëpunon ngushtë me çdo klient për të

projektuar një plan pensioni që përputhet me synimet e biznesit dhe preferencat e individëve.

Siguria: “SIGAL UNIQA Fond Pensioni” mundëson sigurinë dhe mbrojtjen e investimeve të

punonjësve tuaj, duke investuar në instrumenta financiarë të besueshëm (Obligacione

Shtetërore).

Emri i madh në treg: Duke qenë pjesë e “SIGAL UNIQA Group Austria” dhe “UNIQA

Insurance Group”, ky fond është një garanci më shumë për çdo individ apo biznes.

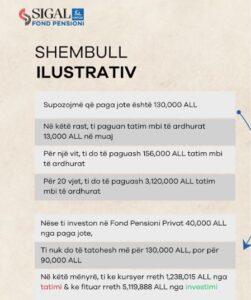

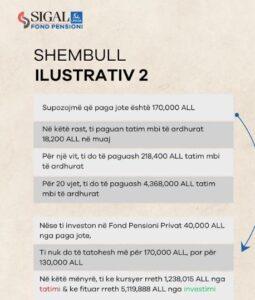

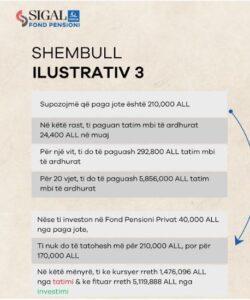

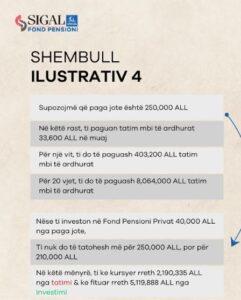

Shembuj investimi:

Dëshironi të hapni një llogari dhe të investoni për të ardhmen tuaj? Ju nevojiten vetëm 1,000

Lekë. KLIKONI KËTU hyperlink (https://fondisigal.com.al/anetaresohu/ )

*CEO i “SIGAL UNIQA Fond Pensioni”